Going Beyond Insurance

We go beyond insurance by identifying the potential risks that can impact your coverage. We’re not your typical agent going through the typical insurance buying process. Consider us your trusted risk advisor.

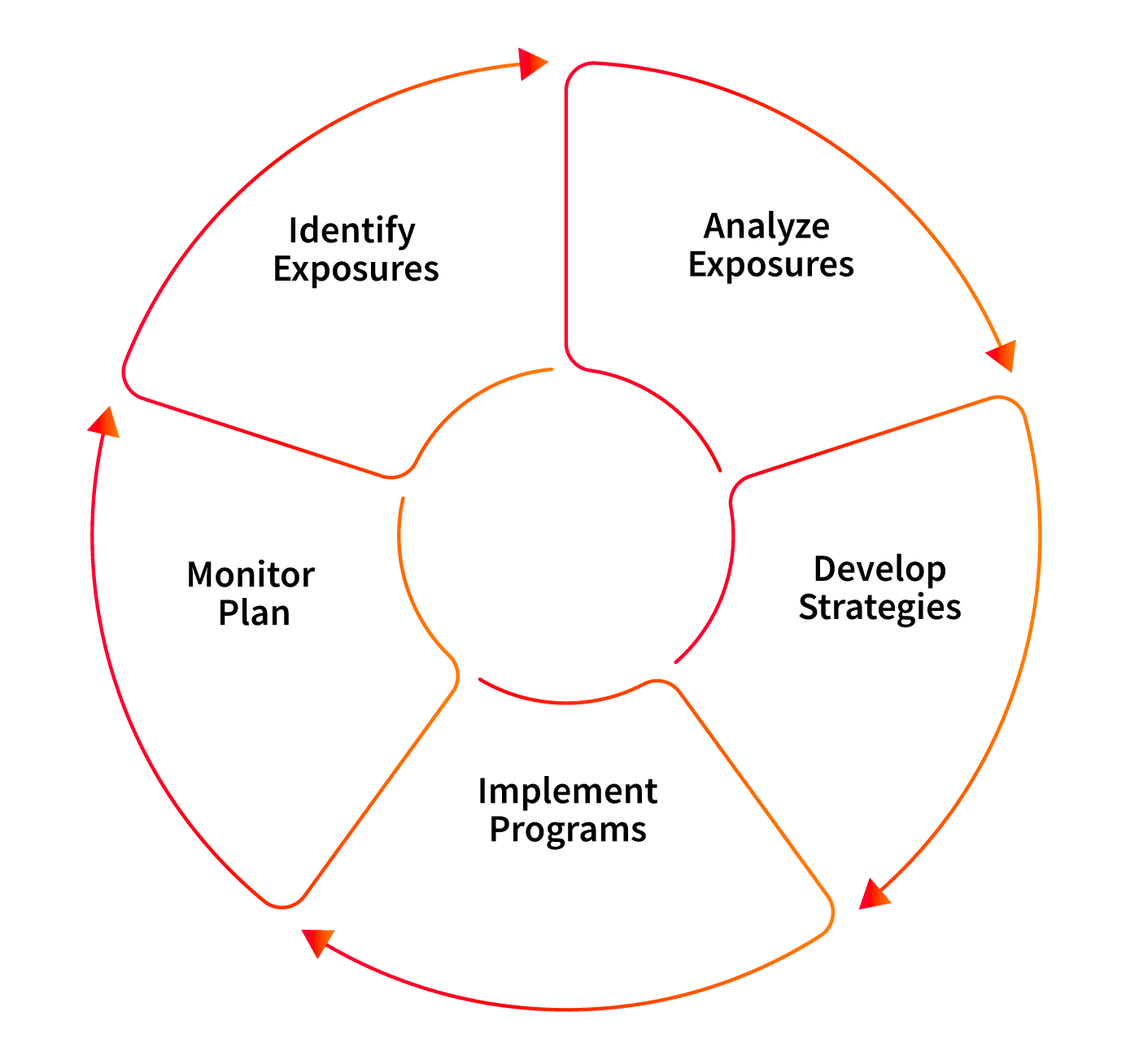

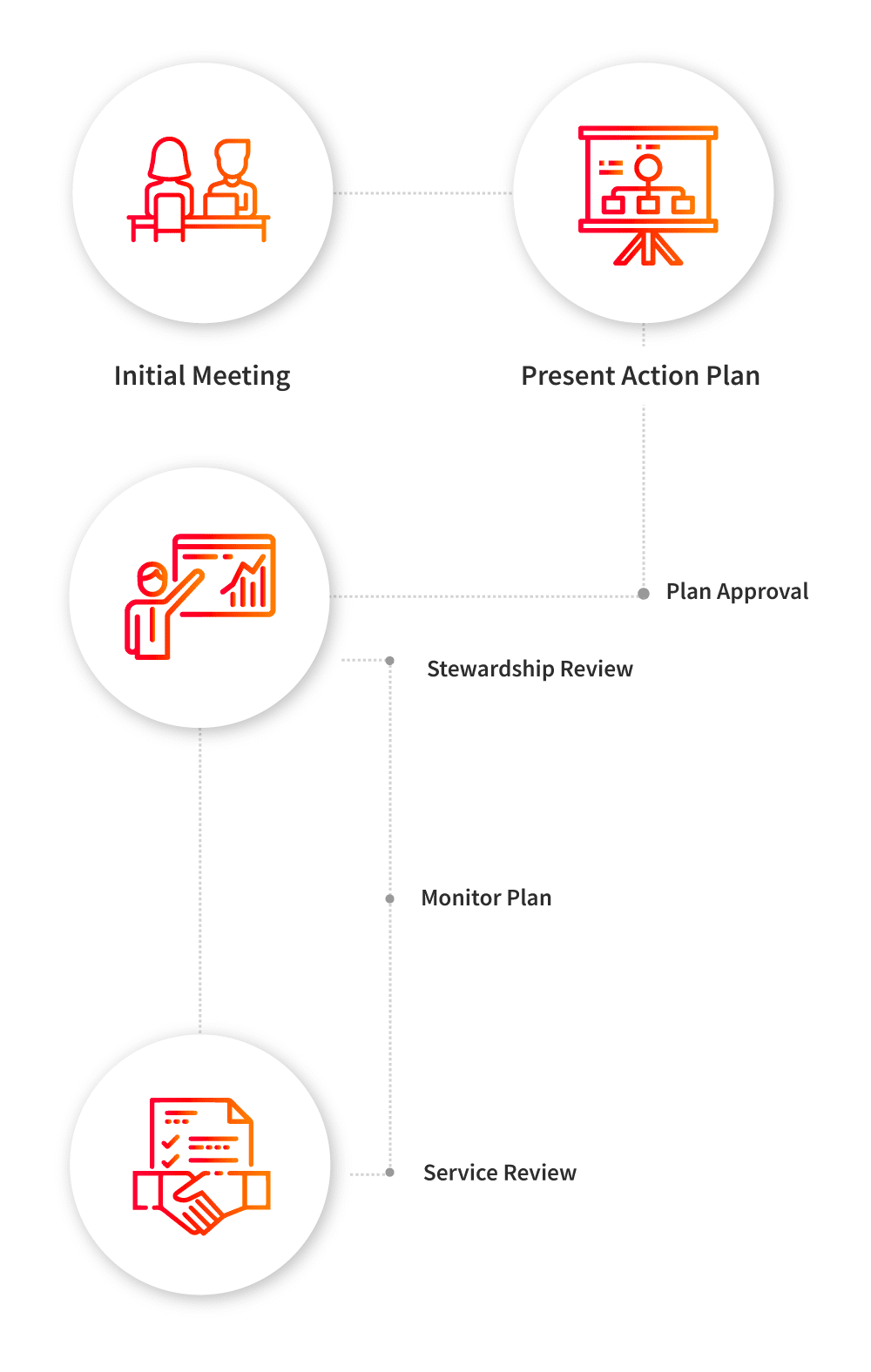

We deploy a five-step process that combines the art of risk management with insurance to help your company reduce, monitor and mitigate risk while securing superior coverage at a comparable rate.

At no cost to you, our risk advisors will identify and analyze your exposures, develop and implement strategies to reduce exposures, and monitor your risk management program as your company grows.

Together we’ll create a portfolio that provides you with the fullest protection based on your needs, while keeping your employees healthy, safe and productive in the workplace.

Proprietary Risk Management Audit

Our innovative process delves in to every facet of your business, how you operate, your goals, and what keeps you up at night. We go beyond insurance, providing you with insurance solutions plus strategies that help you leverage your risk.

The results speak for themselves; 9 out of 10 employers who try our audit end up working with us.

Risk Management 365 Days of the Year

You may not be a Fortune 500 company, but we believe your risks should be managed and monitored just as if you were. We bring the knowledge, tools and strategies to keep your employees healthy and safe, and your business well protected.

Each industry has its own set of unique risks and requires specialized insurance to protect what matters most. Our insurance advisors have in-depth knowledge and experience with a variety of industries, including those featured below.

Our experienced benefits professionals take the time to understand your business. They bring bold thinking and industry expertise to help you stay on top of regulations and economic trends and focus on your first priority—recruiting and retaining the best employees.